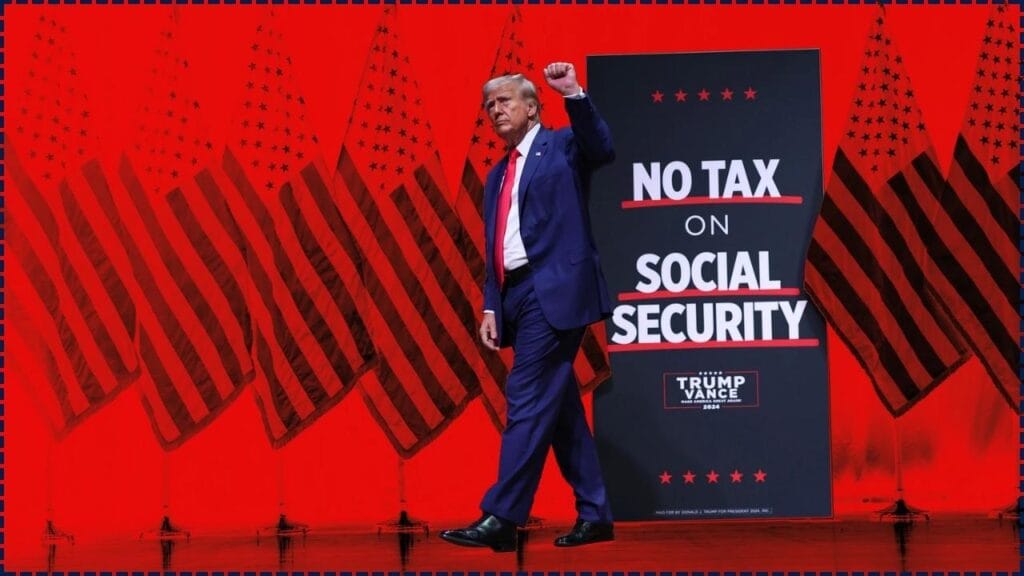

Social Security Taxes Could End Under New Bill: Trump says Social Security taxes could end? That’s the buzz hitting headlines, and it’s stirring a lot of questions. While former President Donald Trump has indeed proposed changes related to Social Security taxation, the truth is a bit more complex. His recent push centers around a new piece of legislation called the “One Big Beautiful Bill Act”, which does include provisions affecting seniors, workers, and certain federal tax structures.

Let’s break it all down—what’s in the bill, what’s being proposed, and what this really means for you and your paycheck.

Social Security Taxes Could End Under New Bill

| Topic | Details |

|---|---|

| Bill Name | One Big Beautiful Bill Act |

| Social Security Tax Proposal | Enhanced deductions for seniors; no full repeal yet |

| Other Tax Breaks | Elimination of federal taxes on tips and overtime pay |

| Status | Passed House (215–214); awaiting Senate review |

| Potential Impact | $1.5 trillion in revenue loss over 10 years |

| Official Source | SSA Retirement Benefits Info |

So, is Trump really ending Social Security taxes? Not exactly—but he’s pushing changes that would reduce or eliminate those taxes for many Americans, especially seniors. The bill also includes tax breaks for working folks who depend on tips and overtime.

The bottom line: it’s a promising proposal for some, but it’s not law yet—and comes with budget implications that are sparking heated debate in Congress. Keep an eye on the Senate, because how this plays out could impact your wallet, your benefits, and the future of retirement in America.

What Did Trump Actually Propose?

Former President Donald Trump is backing a comprehensive tax reform bill designed to cut taxes on working- and middle-class Americans. Among the headline promises is eliminating federal taxes on Social Security benefits—a hot-button issue for retirees and seniors living on fixed incomes.

But here’s the thing: while Trump has made bold campaign-style statements about ending these taxes altogether, the legislation currently in play offers more incremental relief rather than a full repeal.

What’s Actually in the Bill?

The “One Big Beautiful Bill Act” includes:

1. Tax Breaks for Seniors

- A $4,000 enhanced standard deduction for Americans over the age of 65.

- This reduces the amount of taxable income, which in turn could make some or all Social Security benefits non-taxable depending on income levels.

2. Elimination of Federal Taxes on Tips and Overtime

- Aimed squarely at restaurant workers, bartenders, hotel staff, and hourly wage earners who rely on gratuities and extra hours to make ends meet.

- Would exempt these types of income from federal income tax.

3. Broader Tax Reform Goals

- Trump’s team touts the bill as part of his broader push for “pro-worker, pro-senior” tax policy.

- It’s framed as relief during inflationary times when cost of living is rising faster than wages or retirement income.

Where Does the Bill Stand Now?

House Approval

The bill passed in the House with a razor-thin margin: 215 in favor vs. 214 against. That’s how contentious it is, even among Republicans.

Senate Status

- The Senate approved a budget resolution that allows reconciliation, a process that permits budget-related bills to pass with just a simple majority.

- However, the bill still faces hurdles from moderates and Democrats concerned about fiscal responsibility.

What’s the Catch?

Budget Trade-offs

Cutting taxes sounds great until you look at the estimated revenue loss—about $1.5 trillion over the next 10 years.

To make up for this, the bill proposes:

- Spending cuts to programs like Medicaid, SNAP (food stamps), and other social services.

- These offsets have drawn heavy criticism from budget watchdogs and advocacy groups.

Not Yet Law

This is still a proposal, not a done deal. Even if it gets through the Senate, expect amendments, revisions, and compromises before anything is signed into law.

How Could This Affect You?

Retirees and Seniors

- You might see lower taxes on Social Security benefits, depending on your income bracket.

- The enhanced deduction could push some seniors out of taxable territory altogether.

Working Americans

- If you earn tips or lots of overtime, you’d keep more of your paycheck under this bill.

- That could mean hundreds to thousands more annually for service industry workers.

Middle-Income Families

- You may get modest income tax relief, but also face cuts in services if federal programs are defunded.

- Budget impact depends on how trade-offs are structured.

FAQs On Social Security Taxes Could End Under New Bill

Q: Is Trump really eliminating Social Security taxes?

A: Not entirely. He’s proposing increased deductions and exemptions that could reduce or eliminate taxes on Social Security income for many, but it’s not a blanket repeal.

Q: Who benefits most from this bill?

A: Seniors, service workers, and people with high overtime earnings could see the biggest tax breaks.

Q: Is this bill law yet?

A: No. It’s passed the House and is under Senate consideration. It must survive negotiations and potential amendments.

Q: How can I see if I pay taxes on my Social Security now?

A: Use the SSA’s online calculator or check your IRS tax return. Benefits are taxable depending on combined income.

Q: Will programs like Medicare be affected?

A: Possibly. Critics say offsets for the tax cuts might reduce funding for social safety net programs, including healthcare assistance.