In 2025, rhodium has emerged as the world’s most valuable precious metal, surpassing gold, platinum, and palladium with a price exceeding $5,500 per ounce, shining a light on its unique role in creating a sustainable future. While its value may outshine even a luxurious getaway, rhodium’s true significance lies in its contributions to cleaner technologies, such as catalytic converters that reduce harmful emissions.

This moment invites us to learn more about this remarkable resource, fostering a shared appreciation for innovations that support the health of our planet and communities, inspiring hope for a greener, more connected world. In this article, we’re breaking it all down: what rhodium is, why it’s so rare, and how it quietly became one of the most critical—and valuable—elements on the planet.

Rhodium Surpasses Gold and Platinum

| Feature | Details |

|---|---|

| Current Price (Jul 2025) | $5,500–$5,675/oz |

| Gold Price | ~$1,900/oz |

| Platinum Price | ~$1,400/oz |

| Palladium Price | ~$1,200/oz |

| Annual Rhodium Supply | ~30 metric tons globally |

| Main Uses | Auto catalytic converters (90%), electronics, glass, jewelry |

| Top Producer | South Africa (80%+ global share) |

| Outlook | Supply deficit expected until at least 2027 (USGS) |

Rhodium, a rare and precious metal, may be unfamiliar to many, yet its impact touches lives across the globe, playing a vital role in fostering cleaner, healthier environments. In 2025, it shines as the most valuable precious metal, driven by its essential use in the automotive industry to reduce emissions and a limited global supply. Whether you’re an investor, a car owner, or simply curious, learning about rhodium connects us to a shared vision of sustainability and innovation, inspiring us to support technologies that nurture our planet and uplift communities in today’s interconnected economy.

From rising thefts to investment potential, rhodium is more than just shiny—it’s shaping the future of clean air, global trade, and even your wallet.

What Is Rhodium, and Why Should You Care?

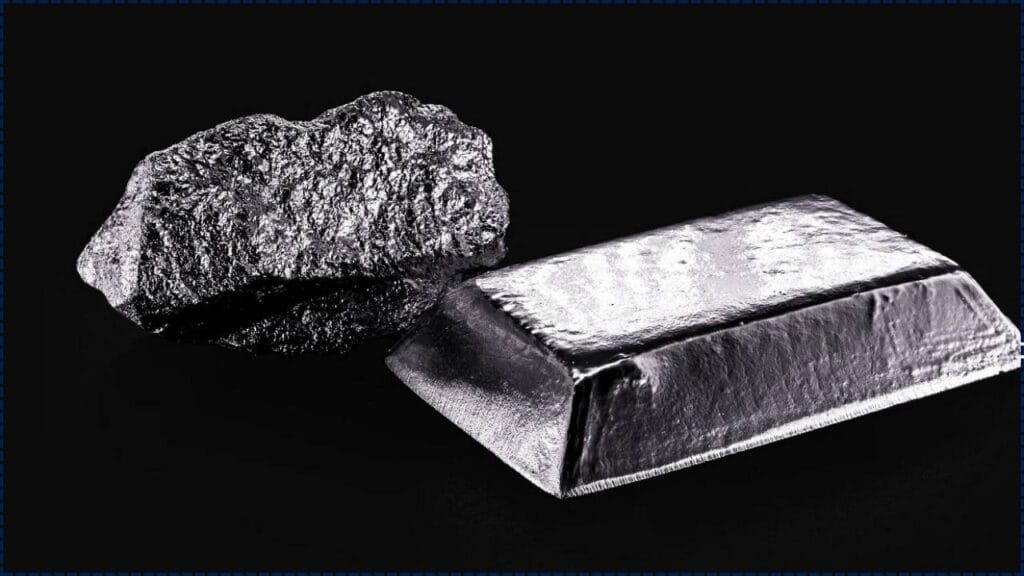

Rhodium is a silvery-white, corrosion-resistant metal that belongs to the platinum group. Despite its shiny appearance, it’s not used to make coins or bars like gold. Instead, rhodium is a workhorse of industrial chemistry, especially in the automotive sector.

- Main Job: Breaking down nitrogen oxides in car exhaust systems

- Bonus Use: Adding a reflective finish to jewelry (hello, white gold!)

What makes it special? It’s super rare, extremely heat-resistant, and doesn’t oxidize, even under brutal conditions.

Rhodium Price History: A Wild Ride

Let’s look at how rhodium prices have evolved over time:

| Year | Average Price (USD/oz) |

|---|---|

| 2008 | $10,000+ |

| 2016 | $750 |

| 2021 | $29,000 |

| 2023 | $8,100 |

| 2025 | $5,500–5,675 |

It’s not for the faint of heart. Prices can swing wildly based on geopolitical shifts, environmental laws, and supply chain hiccups.

Why the Auto Industry Is Driving Demand

Over 90% of the world’s rhodium production is dedicated to creating catalytic converters, vital devices that help purify emissions from gasoline-powered vehicles, fostering cleaner air for communities everywhere. As global environmental standards grow stronger, particularly in regions like the EU, China, and California, the demand for rhodium reflects a shared commitment to protecting our planet and ensuring healthier futures. By supporting automakers in meeting these standards, rhodium plays a quiet yet powerful role in uniting us in the pursuit of a sustainable, thriving world for all.

Quick Example: A Toyota Prius catalytic converter contains about 0.02–0.05 grams of rhodium. Doesn’t sound like much, but multiply that by 70 million new cars per year—and you’ve got serious demand.

Why Is Rhodium So Rare?

Rhodium isn’t mined on purpose. It’s extracted in tiny amounts—just 1 gram per 1 ton of platinum ore.

- Main Sources: South Africa, Russia, Canada

- Global Supply: Only ~30 tons per year

- By-Product Mining: Found during platinum and nickel mining

This tight supply, paired with intense demand, creates the perfect storm for price hikes.

Theft and Crime: The Dark Side of Rhodium

Because of its sky-high value, rhodium is a hot target for thieves. Catalytic converter theft is soaring across the U.S.—from Los Angeles to Detroit.

In 2024, the National Insurance Crime Bureau (NICB) reported a 40% increase in catalytic converter thefts, with rhodium being the primary reason.

If you own a hybrid or truck, you’re especially at risk. Protect your vehicle with:

- Cat shields

- Etching VINs

- Motion alarms

Rhodium vs Other Precious Metals

| Metal | Price (oz) | Rarity | Main Use |

|---|---|---|---|

| Rhodium | $5,500+ | Ultra Rare | Auto converters |

| Gold | $1,900 | Moderate | Jewelry, investment |

| Platinum | $1,400 | Rare | Auto, jewelry, medical |

| Palladium | $1,200 | Rare | Auto, electronics |

| Silver | $24 | Common | Electronics, solar panels, coins |

Rhodium blows the others away in price because of limited availability and niche necessity.

Rhodium Surpasses Gold and Platinum Invest in Rhodium (The Right Way)

Unlike gold or silver, you can’t just walk into a store and buy rhodium bars. But there are some ways to get exposure:

1. Rhodium-backed ETFs or ETPs

- Rare but available in Europe and Asia

- Example: Xtrackers Physical Rhodium ETC

2. Mining Stocks

- Invest in companies like Anglo American Platinum or Sibanye-Stillwater

3. Jewelry & Scrap Recovery

- Some investors buy white gold jewelry rhodium-plated for long-term appreciation

Warning: Rhodium is volatile. Only invest what you can afford to lose.

Related Links

Lifting Weights the Wrong Way Could Be Hurting You — New Investigation Reveals the Risks

Millions to Score $5,108 Social Security Payments; Here’s Why They’re Coming Early

Rhodium Outlook 2025–2030

Key Trends to Watch:

- Rise of Electric Vehicles (EVs)→ Could reduce demand since EVs don’t use catalytic converters.

- Stricter Environmental Rules→ May increase demand short-term for hybrids and traditional vehicles.

- Supply Constraints in South Africa→ Power outages and strikes are ongoing issues

Metals Focus Forecast:

- Rhodium expected to outperform platinum and palladium through 2027 due to structural deficits

Environmental & Ethical Issues

Like many mined materials, rhodium production isn’t squeaky clean:

- Most is mined in South Africa under harsh labor conditions

- Environmental degradation is a concern

- Energy-intensive refining process

We need more transparent sourcing, recycling tech, and ethical mining practices going forward.

FAQs

Is rhodium a good long-term investment?

Maybe—but it’s high-risk and highly volatile. Not recommended for beginners.

Can you buy physical rhodium?

Yes, but it’s rare. Look for rhodium sponge or plated coins from specialty dealers.

Does rhodium affect car prices?

Yes! When rhodium is expensive, catalytic converter costs rise—and car repair or manufacturing prices go up too.

Will EVs kill rhodium demand?

Long-term, yes. But in the short-term (2025–2027), hybrids and gas cars still dominate many global markets.