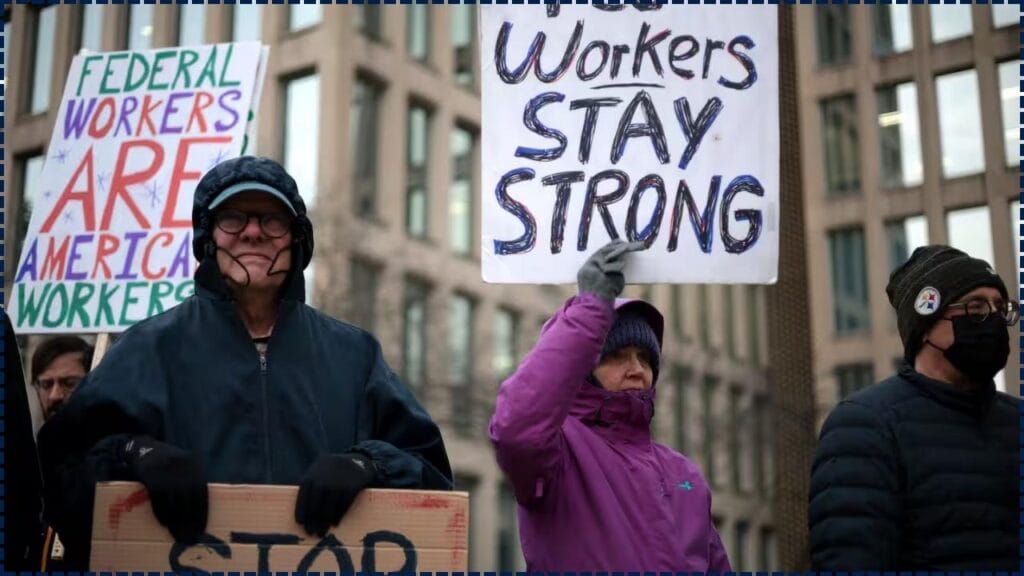

The phrase “Retire Now, Plan Later?” is hitting a little too close to home for many federal workers. A new proposal from House Republicans has stirred up real concern among current and future government employees, raising serious questions about federal retirement benefits, job security, and what it means to work in public service in 2025 and beyond.

In May 2025, the House narrowly passed a budget reconciliation bill — 215 to 214 — that includes some major changes to federal employee retirement plans. While certain controversial provisions were scrapped under pressure, others remain, and they’re leaving workers uneasy.

GOP’s New Proposal Leaves Federal Workers in the Dark

| Provision | Details | Effective Date | Who It Affects |

|---|---|---|---|

| FERS Annuity Supplement Elimination | Ends benefit for early retirees before 62 | Jan 1, 2028 | Most federal workers retiring early |

| New Hire Employment Terms | Choice between at-will status or higher retirement contributions | Upon enactment | New hires only |

| MSPB Appeal Fee | $350 to appeal personnel decisions | Upon enactment | All federal employees |

| FERS Contribution Increase | Removed | N/A | Was aimed at pre-2014 hires |

| High-3 to High-5 Calculation | Removed | N/A | Would have lowered annuity for retirees |

The GOP’s latest budget proposal, while modified, still poses real concerns for federal employees — especially future retirees. While some of the worst cuts were taken off the table, the remaining provisions show a clear shift in how retirement and job protections may look for public servants.

If you work for the government or plan to, now is the time to review your benefits, ask questions, and prepare. Retirement should be something you plan with confidence, not fear. This isn’t just politics — it’s your future.

What’s Changing for Federal Workers?

1. FERS Annuity Supplement on the Chopping Block

Let’s break this down: the FERS annuity supplement is designed to bridge the gap for federal employees who retire before age 62. It mimics Social Security benefits until the real checks kick in.

Under the GOP bill, this supplement would be eliminated starting in 2028, but mandatory early retirees — like firefighters, law enforcement, and air traffic controllers — are exempt.

This is a huge deal for workers planning to retire early. They might now need to work longer or rethink their savings strategy.

2. New Hire Contracts: Choose Your Own Risk

Starting the day the bill becomes law, new federal employees will have to pick between:

- At-will employment with standard retirement contributions (about 0.8% to 4.4%), OR

- Full civil service protections, but with a higher FERS contribution rate (an extra 5%)

So it’s basically: job security vs. paycheck.

Imagine telling a college grad: “Hey, welcome to government service! Now choose between less job protection or less take-home pay.” Yeah, not exactly a great recruiting pitch.

3. MSPB Appeal Fee: Pay to Push Back

Federal employees who want to appeal a disciplinary action to the Merit Systems Protection Board (MSPB) would now pay $350 just to file. Sure, it’s refundable if you win, but for many workers, that’s a steep upfront cost — and could discourage legitimate claims.

It’s a move critics say could chill whistleblowing and limit due process.

What Got Cut From the Original Plan?

1. FERS Contribution Hike — Nixed

Originally, the plan was to increase FERS contributions for everyone (even folks hired before 2014) up to 4.4%. That would’ve been a direct hit to net pay. Thanks to bipartisan backlash, that provision was dropped.

2. High-3 to High-5 Pension Calculation — Also Gone

This change would’ve recalculated retirement benefits using an employee’s highest five years of salary, instead of three, effectively lowering pension payouts. That also didn’t make the cut.

What Does This Mean for You?

If You’re Close to Retirement…

- The FERS annuity supplement is still safe for now if you retire before Jan 1, 2028.

- Keep tabs on Medicare eligibility and Social Security timelines so you’re not left with a gap.

If You’re a New or Future Federal Hire…

- Weigh the pros and cons of at-will vs. protected employment.

- Think about increasing your Thrift Savings Plan (TSP) contributions to make up for future benefits that may be cut.

If You’re Still Early in Your Career…

- Stay politically informed. Changes to federal benefits often come back around.

- Revisit your financial plan annually to adjust for any future legislation.

Real-Life Example: Meet Angela, a Mid-Career Analyst

Angela, 45, has worked for the Department of Education since 2005. She planned to retire at 59 and count on the FERS supplement until Social Security kicks in. Under this proposal, she’d lose that buffer, meaning she might have to:

- Work an extra 2-3 years, or

- Increase her TSP contributions now, or

- Take on part-time work post-retirement

“It’s frustrating,” she says. “You make a plan for 20 years, then Congress rewrites the rules overnight.”

FAQs

Q: Will I lose my FERS annuity supplement if I retire in 2027?

No. The proposed cut starts January 1, 2028 and only affects those who retire after that.

Q: Does the $350 MSPB appeal fee apply to everyone?

Yes. All federal workers would be required to pay the fee, but it would be refunded if the appeal is successful.

Q: I’m thinking about a federal job. Should I still apply?

Absolutely — just go in informed. The benefits are still competitive, but you’ll need to plan for long-term savings.

Q: Can these proposals still change?

Yes. The bill heads to the Senate, where further amendments could strip or soften these provisions.

Q: What can federal employees do to stay prepared?

- Monitor updates via Federal News Network

- Increase savings in your TSP

- Consult a financial advisor who specializes in federal retirement benefits