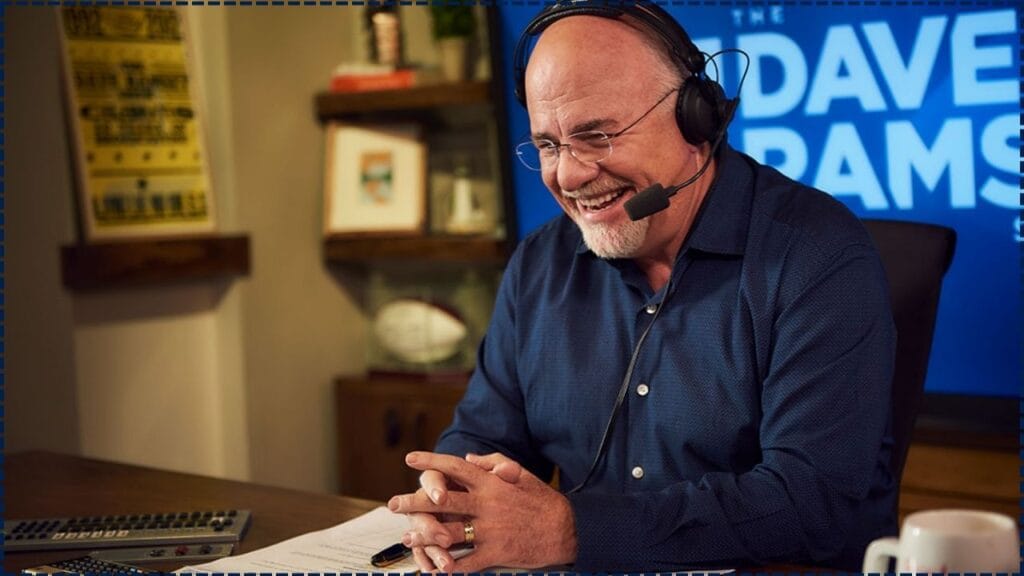

Dave Ramsey Goes Off on DC: Dave Ramsey goes off on DC: ‘Do your job’—calls out leaders for financial irresponsibility during a fiery address at the 2025 EntreLeadership Summit in Denver. Known for his no-nonsense advice on personal finance, Ramsey didn’t hold back as he tore into lawmakers for creating economic chaos, ignoring the needs of small businesses, and failing to uphold fiscal discipline.

His message? Get it together, Washington. The economy doesn’t run on drama, and entrepreneurs can’t build success on uncertainty. Let’s unpack what he said, why it matters, and how it connects to every American wallet.

Dave Ramsey Goes Off on DC

| Topic | Dave Ramsey’s Take | Why It Matters | Resource |

|---|---|---|---|

| Political Infighting | Called it “absolute BS” and a threat to economic confidence | Gridlock prevents action on taxes, healthcare, and small business support | NY Post |

| Economic Instability | Blamed “unpredictability” of tariffs, taxes, and policy for harming small biz | Entrepreneurs can’t plan or hire under unclear conditions | Ramsey Solutions |

| Small Business Advocacy | Urged Congress to support owners, simplify taxes, and stop penalizing success | Small business is 44% of U.S. economic activity | SBA |

| Call to Action | “Do your job.” | Government dysfunction hurts everyone—not just the wealthy | EntreLeadership |

Dave Ramsey’s message is a wake-up call. America’s future depends on clear-headed leadership that puts citizens and small businesses first. His demand for Congress to “do your job” isn’t just political theater—it’s a reminder that economic stability is built on trust, responsibility, and straight-up common sense.

So whether you’re a small biz owner, a worker, or a parent trying to plan your budget, remember: what happens in D.C. affects Main Street. And it’s okay to demand better.

What Dave Ramsey Said and Why It Hit Home

Dave Ramsey isn’t a politician. He’s not trying to get your vote. But when he talks money, people listen—and this time, he turned his spotlight straight on Capitol Hill.

“These guys spend half their lives and a lot of money just trying to keep from getting the snot beat out of them by Washington,” Ramsey said, referring to the hoops small business owners jump through just to stay afloat.

He argued that America’s entrepreneurs are being stifled by over-regulation, inconsistent policies, and the uncertainty created by partisan bickering. Whether it’s tariffs that change month to month or complex tax codes that take an accountant and a crystal ball to decode, small business owners are feeling the squeeze.

What Small Business Owners Are Dealing With Right Now

Running a business in America isn’t easy—especially in a post-pandemic, high-inflation environment. Here’s what Ramsey and others are pointing to:

1. Unpredictable Tax Laws

Ramsey says that without consistent tax codes, business owners can’t plan ahead. And he’s right—the U.S. tax code is so complicated that even seasoned professionals struggle with it.

- Fact: The U.S. tax code has over 70,000 pages. (IRS.gov)

- Impact: One wrong move can mean heavy penalties or missed deductions.

2. Tariff Jumps and Trade Tensions

Ramsey emphasized how tariffs (like those on Chinese imports or Mexican steel) mess with business planning. Prices rise, supply chains break, and profit margins disappear overnight.

- Fact: The U.S. imposed more than $80 billion in tariffs between 2018 and 2024. (Brookings Institution)

3. Rising Costs of Regulation

The average small business spends $83,000/year just to comply with federal regulations. That’s money that could go toward hiring, upgrading equipment, or expanding.

How Government Instability Impacts Your Wallet

Even if you’re not a business owner, these problems hit home:

- Higher Prices: Tariffs increase costs for everyone.

- Job Insecurity: Small businesses employ nearly 62 million Americans. If they suffer, job creation slows.

- Fewer Local Services: Businesses close, and communities lose.

“You can’t build a future on a foundation that changes every time Congress gets into a fight,” Ramsey warned.

Ramsey’s Policy Suggestions in Plain English

Dave didn’t just rant—he offered real ideas:

1. Flat Tax or Simplified Tax Code

Make it easier to file, easier to comply, and harder to cheat. A flat tax or a few clear brackets could fix much of the mess.

2. Stable Tariff Policies

Trade is global. Businesses need consistency. Let companies adjust, but don’t leave them guessing.

3. Incentives for Hiring

Reward small businesses for creating jobs instead of punishing them with more red tape.

4. Fiscal Responsibility in Government

This is big: spend within your means. America’s debt is over $34 trillion. Ramsey says if families can budget, so can Congress.

FAQs On Dave Ramsey Goes Off on DC

Why did Dave Ramsey call out Congress?

Because government dysfunction hurts regular Americans—especially small business owners trying to make ends meet.

What does he want changed?

He wants predictability in taxes and tariffs, less bureaucracy, and for leaders to focus on real solutions.

Does Ramsey offer solutions?

Yes. He supports fiscal responsibility, a simplified tax code, and incentive-based economic policies.

What can I do as a citizen?

Stay informed. Vote. Support local businesses. Call your reps. And manage your own finances wisely, so you’re not relying on D.C. to save you.

Takeaway for Entrepreneurs

Whether you run a food truck, freelance from home, or own a regional company, Ramsey’s words ring true. You need policies that support growth—not red tape that strangles it.

Action Steps:

- Review your tax strategy and hire a pro if needed.

- Track government policies that affect your industry.

- Diversify your suppliers to avoid tariff shocks.

- Speak up at town halls or write your representatives.

Related Resources

- Ramsey Solutions – Business Leadership

- Small Business Administration (SBA)

- IRS Small Business Tax Center

- EntreLeadership Resources