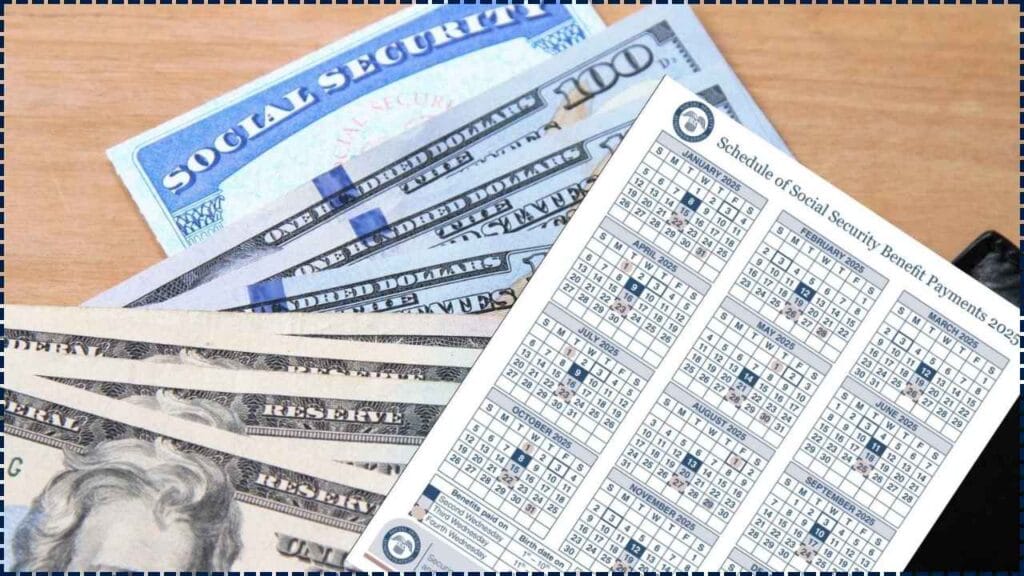

SSDI Payments Are Coming in Late May or Early June: If you’re living on Social Security Disability Insurance (SSDI), you know the drill: every dollar counts, and knowing when your next payment hits your account is essential. Well, here’s a heads-up — SSDI payments are coming in late May or early June 2025, depending on your birthday and how the calendar shakes out. Don’t let a delay catch you off guard.

We’re breaking it all down right here: payment dates, eligibility criteria, how to apply, and what to do if your check’s late. Whether you’re a seasoned SSDI recipient or just getting started, this guide is for you.

SSDI Payments Are Coming in Late May or Early June

| Topic | Details |

|---|---|

| May 2025 SSDI Pay Dates | May 14, May 21, May 28 |

| June 2025 SSDI Pay Dates | June 11, June 18, June 25 |

| Payment Based On | Your birth date: 1–10 (2nd Wed), 11–20 (3rd Wed), 21–31 (4th Wed) |

| SSI June Payment Date | May 30, 2025 (because June 1 falls on a Sunday) |

| SSDI Max Benefit (2025) | Up to $4,018/month (based on earnings history) |

| Eligibility Requirements | Medical disability, work credits, income below Substantial Gainful Activity (SGA) limits |

| Official SSA Website | ssa.gov |

SSDI payments for late May and early June 2025 are rolling out based on your birth date, and SSI recipients are also getting an early check at the end of May. If you’re not on SSDI yet, now’s a great time to check if you qualify. For many, it’s a game-changer — the financial lifeline they need.

Stay sharp, check your payment schedule, and keep your info up-to-date with the SSA. You’ve earned it.

SSDI Paydays in May and June 2025

SSDI payments aren’t sent on the same day for everyone. The Social Security Administration (SSA) uses your birth date to assign a payment schedule:

- If your birthday is on the 1st–10th: You get paid on the second Wednesday of the month

- If it’s the 11th–20th: Expect payment on the third Wednesday

- If it’s the 21st–31st: You’re up on the fourth Wednesday

May 2025 Payment Dates

- May 14: Birthdays 1st–10th

- May 21: Birthdays 11th–20th

- May 28: Birthdays 21st–31st

June 2025 Payment Dates

- June 11: Birthdays 1st–10th

- June 18: Birthdays 11th–20th

- June 25: Birthdays 21st–31st

If your payment day falls on a federal holiday, SSA sends the money the day before. So, mark your calendar and double-check those dates.

SSI Payments: May Has a Twist

Supplemental Security Income (SSI) runs on a different schedule. It normally lands on the 1st of the month. But when the 1st is a weekend or holiday, it’s sent early.

Since June 1, 2025, is a Sunday, SSI checks will be paid Friday, May 30. Yep, that means two payments in May (May 1 and May 30), and no payment in June.

SSDI Eligibility Requirements: Do You Qualify?

SSDI isn’t a handout. It’s an insurance program you pay into through payroll taxes. To qualify, you need to check these boxes:

1. You have a medical disability

- Must be severe, long-term (12+ months), or expected to result in death

- Must prevent you from performing any kind of work

- SSA uses the “Blue Book” criteria for qualifying conditions (SSA Disability Criteria)

2. You have enough work credits

- In 2025, you earn 1 credit for every $1,810 in wages

- You can earn up to 4 credits per year

- Most folks need 20 credits earned in the last 10 years, but younger people may qualify with fewer

3. You earn below SGA thresholds

- $1,620/month for non-blind disabled individuals

- $2,700/month for blind individuals (SSA SGA info)

How Much Could You Receive?

Your monthly SSDI benefit depends on your earnings history. Here’s a rough idea:

- Average benefit (2025): ~$1,580/month

- Maximum benefit: $4,018/month (for high earners)

Remember, you may get less if you also receive other government aid like workers’ compensation or SSI.

SSDI Payments Are Coming in Late May or Early June Apply for SSDI in 2025

Thinking about applying for SSDI? Here’s how to do it without pulling your hair out:

- Gather your info: ID, work history, medical records, prescriptions

- Apply:

- Online: ssa.gov/applyfordisability

- Phone: 1-800-772-1213

- In-person: Schedule an appointment at your local SSA office

- Wait and respond:

- It takes 3–6 months for initial decisions

- SSA may contact you or your doctors for more info

- Appeal if needed: If denied (which is common), file an appeal within 60 days

What to Do If Your SSDI Payment Is Late

Don’t panic if your payment doesn’t show up exactly on time. Here’s what you should do:

- Wait 3 mailing days

- Check your “My Social Security” account: ssa.gov/myaccount

- Call SSA at 1-800-772-1213

- Double-check with your bank or direct deposit provider

Tips for Managing SSDI Benefits

- Use direct deposit: It’s faster and safer than waiting for a paper check

- Track your income: Earning above the SGA limit can disqualify you

- Watch for COLA: SSDI benefits usually get an annual boost in January based on inflation

- Look into SNAP, Medicaid, and housing help if your SSDI check isn’t enough

SSDI Payments Up to $4,018 Will Be Sent This Week – Check If You Are Eligible to Get it!

2026 COLA Projection for SSDI and SSI Benefits: Check Expected Increase and Payment Dates!

SSDI Payment For SNAP Recipients On May 28: Check Eligibility Criteria and Payment Details!

FAQs On SSDI Payments Are Coming in Late May or Early June

Q: Can I get both SSDI and SSI?

Yes! If your SSDI check is low, you may also qualify for SSI, which can boost your total monthly income.

Q: Is SSDI taxable?

It depends. If you have other income (like a spouse’s earnings or retirement income), you might owe taxes on part of your SSDI.

Q: Can I work while on SSDI?

Yes, but you must stay under the SGA limit. SSA also has a “Ticket to Work” program that lets you test working without losing benefits right away.