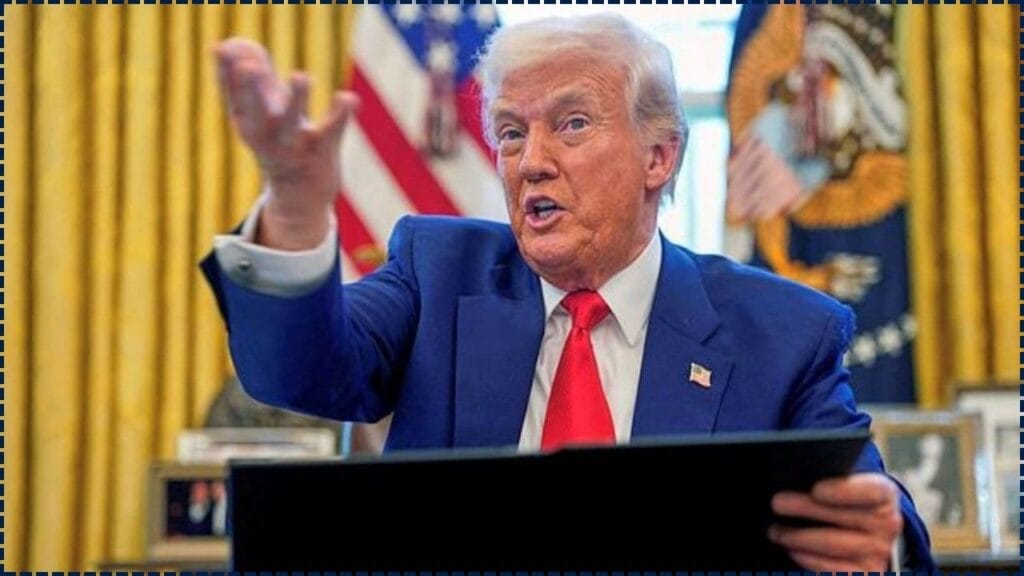

Trump’s Sudden Tariff Reversal: Trump’s sudden tariff reversal on EU goods has sparked a major Wall Street rally, but not everyone is popping champagne. While American and European markets celebrated the delay in sweeping tariffs, Asia reacted with mixed signals, revealing deeper concerns about global trade stability and tech sector exposure.

The decision came after a surprise announcement by former President Donald Trump to push back 50% tariffs on European Union imports to July 9, following a phone call with European Commission President Ursula von der Leyen. The move gave U.S. investors some breathing room—and stocks rallied—but it wasn’t enough to ease anxiety abroad.

Trump’s Sudden Tariff Reversal

| Aspect | Details |

|---|---|

| Tariff Delay | 50% tariffs on EU goods postponed to July 9 |

| Wall Street Reaction | Dow Jones +417 points (1%), S&P 500 +1.1%, Nasdaq-100 +1.2% |

| European Markets | DAX +1.7%, CAC 40 +1.3% |

| Asian Markets | Mixed: Tokyo and Seoul gained; Shanghai and Hong Kong fell |

| Tech Sector Fallout | Apple shares fell 3% on threat of 25% tariff on foreign-made iPhones |

| Investor Sentiment | Temporary relief but uncertainty remains ahead of July 9 deadline |

Trump’s tariff delay gave markets a short-term boost, but the bigger picture remains cloudy. As the July 9 deadline looms, global markets will continue to sway on each new headline. Whether this is a turning point or just a detour in escalating trade tensions remains to be seen.

If you’re a business owner, investor, or just someone shopping for a new iPhone, stay alert—because what happens next could hit home.

What Sparked the Tariff Reversal?

Late last week, Trump announced a delay in the controversial 50% tariff hike on EU imports, a move that had investors on edge. According to White House insiders, this came after a “constructive” conversation with EU President von der Leyen.

“The President has agreed to revisit the trade measures after further dialogue,” read a short press release from the administration.

This “pause button” temporarily lifted fears of a full-blown trade war between the U.S. and EU—a relief for exporters, importers, and anyone watching inflation trends.

How Did the Markets React?

U.S. Stock Surge

Markets wasted no time reacting to the news. On Monday morning:

- Dow Jones futures jumped 417 points

- S&P 500 futures increased by 1.1%

- Nasdaq-100 climbed 1.2%, with heavy buying in consumer goods, manufacturing, and industrials

The delay cooled some inflation fears and gave a temporary vote of confidence to traders who were bracing for cost spikes on European imports.

European Confidence Boost

Across the Atlantic, European stock exchanges also got a boost:

- Germany’s DAX surged 1.7%

- France’s CAC 40 rose 1.3%

- The euro strengthened against the U.S. dollar, reaching $1.1404—the highest in nearly a month

Asia Holds Back

In Asia, however, markets weren’t as rosy:

- Tokyo’s Nikkei and Seoul’s Kospi saw moderate gains

- But Hong Kong’s Hang Seng and Shanghai Composite fell due to concerns over tech sector targeting and broader trade volatility

Investors in Asia appear skeptical about how durable this tariff pause really is, especially with Apple and other U.S. tech giants caught in the geopolitical crossfire.

Breaking Down the Impact on Key Sectors

1. Technology

Apple took a hit, with shares falling 3% after Trump floated the idea of a 25% tariff on iPhones assembled outside the U.S. Since most iPhones are produced in China and Southeast Asia, this sent jitters across supply chains and Wall Street.

2. Agriculture and Autos

European auto and agri-exporters—especially from Germany and France—stand to benefit the most from the delay. American importers of wine, cheese, machinery, and luxury vehicles breathed a collective sigh of relief.

3. Manufacturing and Retail

U.S. manufacturing stocks rebounded slightly as tariff pressure eased. Retailers importing high-end European goods (think fashion, tech, homeware) also saw gains.

The Trade Game—What Happens Next?

Here’s a quick guide to what this all means and how we got here:

- The Threat: Trump’s administration had previously announced a 50% tariff on a wide swath of EU imports, citing unfair subsidies and trade imbalances.

- The Reversal: On May 24, Trump delayed implementation until July 9, citing progress in EU talks.

- Strategic Pressure: The reversal is seen by some analysts as a tactic to buy time while leveraging stronger negotiation terms from Europe.

- Potential Retaliation: The EU is still preparing countermeasures. If negotiations stall, retaliatory tariffs could kick in, targeting U.S. agriculture, tech, and aviation.

- Investor Positioning: Investors now face a 6-week window of volatility, with cautious optimism that cooler heads will prevail.

FAQs On Trump’s Sudden Tariff Reversal

Q: Why did Trump delay the tariffs?

A: Likely due to EU negotiations and concerns over inflation, economic blowback, and global market reactions.

Q: Who benefits from the delay?

A: U.S. consumers, European exporters, and companies relying on transatlantic supply chains.

Q: Will the tariffs still happen on July 9?

A: That’s unclear. It depends on how talks with the EU go. Some believe it’s a bluff; others see it as conditional diplomacy.

Q: Why is Asia worried?

A: Asian markets fear that escalating U.S.-EU tensions could ripple globally, especially hitting supply chains involving China, Korea, and Southeast Asia.

Q: What should investors do?

A: Watch for policy updates, earnings reports from exposed sectors, and shifts in bond yields and commodity prices.

How This Affects the Average American

Even if you’re not trading stocks, this situation affects your wallet:

- Imported goods like cars, wine, and electronics may stay cheaper (for now)

- Retail prices might hold steady if tariffs remain paused

- Travel to Europe could be cheaper if the dollar stays strong

But if talks fail, expect price hikes and potential shortages in certain goods.

Final Word – What We Can Expect Moving Forward

The market may be celebrating today, but investors, businesses, and everyday Americans should keep a close eye on July 9. This pause in tariffs may be just that—a pause.

If new trade terms aren’t hashed out by then, expect markets to wobble again. And if tech-sector tariffs kick in, they could send ripples through supply chains from Shenzhen to Silicon Valley.

“It’s a fragile dance,” said Lydia Kwan, international trade analyst. “Right now, one misstep could mean major consequences.”