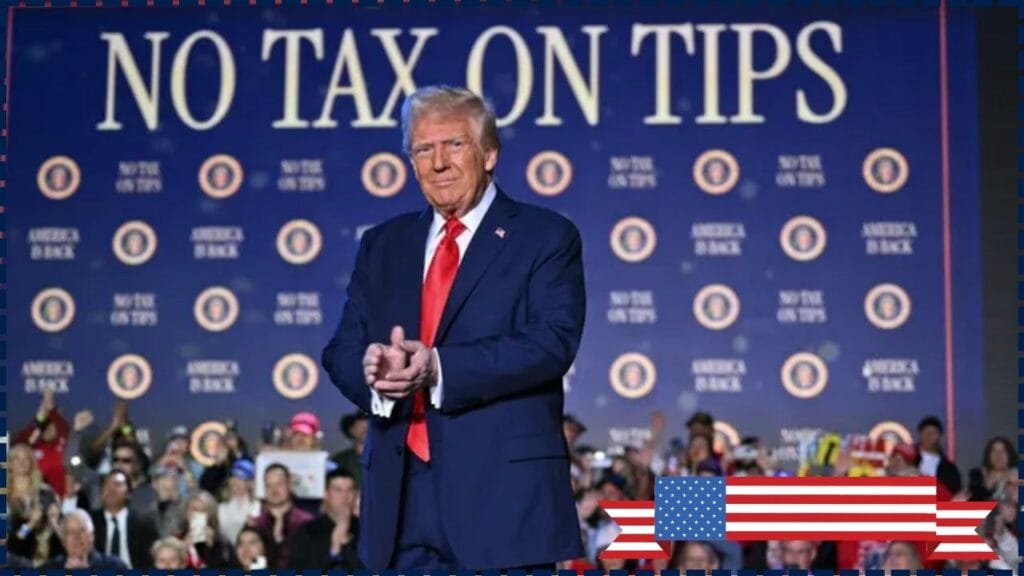

U.S. May Eliminate Tip Taxes Soon: The U.S. may eliminate tip taxes soon, thanks to the newly introduced “No Tax on Tips Act.” This bold move could change the financial game for millions of workers in the service industry, especially servers, bartenders, baristas, and others who depend on tips to make ends meet. The legislation, if passed by the House, would exempt up to $25,000 in tips from federal income tax, aiming to boost take-home pay and support working-class Americans.

While some hail the bill as a long-overdue benefit for workers in hospitality and food service, others argue it may not go far enough or could actually entrench wage problems further. Let’s break down what this proposal is all about, what it means for tipped workers, and the potential pros and cons you should know about.

U.S. May Eliminate Tip Taxes Soon

| Topic | Details |

|---|---|

| Bill Name | “No Tax on Tips Act” |

| Senate Status | Passed unanimously |

| Income Exemption | Up to $25,000/year in reported tips |

| Income Limit | Applies to individuals earning less than $160,000/year |

| Affected Workers | Tipped professions including servers, bartenders, valets, hairdressers |

| Treasury Action | Must define which occupations qualify within 90 days |

| Expiration | Set to sunset after four years, unless renewed |

| Estimated Cost | $40 billion over four years, per Congressional Budget Office |

| Source | Congress.gov |

The proposed “No Tax on Tips Act” could be a major win for America’s service industry workers. While not perfect, the bill shows strong bipartisan interest in boosting take-home pay for people who often rely on unpredictable income. Whether it becomes law or sparks a broader push for wage reform, one thing’s clear: America is starting to take a fresh look at how we tax—and value—tipped work.

What Is the “No Tax on Tips Act?”

A Big Shift for Service Workers

The “No Tax on Tips Act” is a bipartisan bill aimed at putting more money back into the pockets of America’s tipped workers. Here’s how it works:

- If passed into law, workers who earn tips would be able to exclude up to $25,000 per year from their federal income taxes.

- The deduction would apply only to people earning less than $160,000 annually.

- To qualify, workers must report tips via W-2s, and those tips must be tracked and documented by their employers.

The Department of the Treasury is expected to issue official guidance on which jobs qualify for the deduction.

Who Benefits Most?

Tip-Earning Employees in the Spotlight

This law mainly benefits folks in traditionally tipped industries, such as:

- Restaurant servers and bartenders

- Hair stylists and barbers

- Hotel bellhops and valets

- Casino dealers

- Delivery drivers and coffee shop staff

For example, a restaurant server making $35,000 a year (with $20,000 in tips) could see a tax reduction that boosts their take-home pay by $2,000 to $3,000 annually, depending on other deductions.

Why This Matters Now

With inflation still putting pressure on American families, especially in cities with high living costs, an extra couple thousand bucks a year can make a serious difference.

Additionally, restaurants and bars are facing worker shortages, so this bill could make these jobs more attractive by increasing after-tax earnings.

The Flip Side – Criticisms and Concerns

1. It May Not Help the Lowest-Income Workers

Many tipped workers already don’t earn enough to pay federal income taxes. So, while the bill helps some, it might not benefit those who need it most.

2. It May Reinforce the Tipped Wage System

Critics, including labor advocates, argue this could stall momentum for raising the federal tipped minimum wage, which is still $2.13/hour in many states.

3. Budget Concerns

The Congressional Budget Office estimates this bill could reduce federal revenue by $40 billion over four years. Some say this tax cut could be better used to fund broader labor or healthcare reforms.

U.S. May Eliminate Tip Taxes Soon Guide – What Workers Should Do Now

- Track Tips Carefully:

- Use a notebook, app, or employer software to log daily tips

- Make sure your employer reports tips on your W-2 form

- Stay Updated on Occupation Eligibility: Monitor announcements from the Treasury Department or ask your manager/union rep

- Adjust Tax Planning:

- If eligible, you may owe less tax or get a bigger refund

- Talk to a tax advisor or use IRS calculators to estimate impact

How This Compares Internationally

Countries like Canada and the UK don’t exempt tips from income tax, but some offer higher minimum wages or universal benefits to service workers.

This U.S. proposal is unique in that it targets income from tips only, potentially offering a short-term relief—but not a full solution to wage instability.

FAQs On U.S. May Eliminate Tip Taxes Soon

Q: Does this apply to cash tips too?

A: Yes, as long as they’re reported to your employer and show up on your W-2.

Q: Is this permanent?

A: No. The bill is set to expire after four years unless Congress votes to extend it.

Q: What if I make over $160,000?

A: You’re not eligible for the tip exemption, even if you work in a tipped job.

Q: What if my tips are under $25,000?

A: You can deduct the full amount of your reported tips, up to that limit.

Q: Could this affect my eligibility for loans or public benefits?

A: Possibly. Lower taxable income could affect things like student loan income-based repayments or subsidies.